Editor’s Note: This blog was originally published by Snooper App. Snooper App was acquired by Wiser Solutions in 2022 and this blog has been revised and repurposed for a global audience. A version of this blog is also published in Inside FMCG.

Despite a shift to harsher cleaning products in some markets and sectors during 2020 with consumers looking to sanitize everything in their houses, the dish care category illustrates the continuing consumer march toward more eco-friendly products.

Wiser Solutions data indicates that 25 percent of dish liquid buyers consider eco-friendliness as a top criteria when purchasing a dish product and more than 90 percent of shoppers are willing to try eco-friendly alternatives. However, this is tempered somewhat by price, with 40 percent indicating they would switch to eco-friendly alternatives if the price is comparable1.

Nevertheless, the rise of eco-friendly products continues apace.

A 2019 article in Inside FMCG indicated that in dish care there was a shift to eco-friendly brands, with Earth Choice bought by nearly 1 in 4 dishwashing liquid buyers, up nearly two points from two years prior, and Green Choice purchased by 2.5 percent. The growth of these brands was coming at the expense of major brands such as Morning Fresh, Palmolive, and Fairy2. Roy Morgan data from the same period indicated something similar. Eco brands in homecare had begun to proliferate, including Ecostore, Aware, Organic Choice, and Uniquely Natural.

Fast Forward To 2021

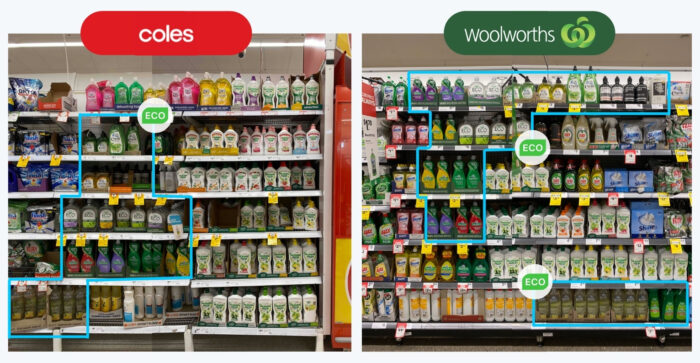

A snapshot from some IGA stores reviewed by Wiser shows the growth of shelf space allocated to eco products in liquid dish care, even in a category in decline as consumers shift into dishwasher tablets due to the increase in dishwasher penetration as a result (among other reasons) of an increase in kitchen renovations since COVID-19.

IGA in Summer Hill, NSW for instance showed a 3x increase in Earth Choice facings since 2014 and a 1.8x increase in facings for Uniquely Natural in the same period. Eco Store, a brand not even ranged in 2014, now has eight facings. These three brands collectively now command 39 percent share of shelf, versus 13 percent in 2014. [See Photos A and B below].

Eco-related claims on pack have also increased markedly. Wiser data indicates an increase of five times for the number of facings with eco claims on pack in the period between 2014 and 2021. This has partially been driven by Palmolive’s eco packaging, given it is one of the leading brands in the dish liquid category. Palmolive claims to now use 100 percent recycled bottles, and last year launched a biodegradable formula dish soap. Two months ago Colgate Palmolive announced a relaunch of its Ultra Dish Soap in 100 percent recycled plastic bottles with clear recycling instructions.

Dish Category Environmentally Friendly Activity Continues Outside The Aisle

Dishwashers have been getting a workout during 2020 and into 2021 due to elevated levels of cooking at home as working from home becomes the norm. Around 20 percent of surveyed consumers in a group of high-cooking-involvement segments had purchased a dishwasher in 2020, and a similar number planned purchases in 2021. We can therefore expect to see a continuation of the rise of dishwasher tablets.

Unsurprisingly, Reckitt Benckiser’s Finish has therefore reignited its #FinishWaterWaste initiative.

Originally launched in September 2019, #FinishWaterWaste was predicated on a data point that presumed by stopping the consumer habit of pre-rinsing dishes before stacking them in the dishwasher, Australians could save up to 40 litres of water per load and collectively save 20 billion litres of water in one year. Australians were encouraged to share social media posts or make in-store purchases to trigger a donation of 40 litres of water, ultimately amounting to 6.8 million litres delivered in 2019. Off-location displays of the initiative were observed by Wiser shoppers throughout 2020, see photo.