Editor’s Note: This blog was originally published by Snooper App. Snooper App was acquired by Wiser Solutions in 2022 and this blog has been revised and repurposed for a global audience.

As we enter the festive season in December, the battle for visibility in-store and in retailer media is fierce for manufacturers playing in the “Snacks and Treats” categories as they all try to win shoppers’ hearts for seasonal gifting and entertaining occasions.

We looked at in-store activations and catalogues investments in 2021 and leveraged our Share of Visibility (off-location) and our Share of Voice (catalogue) data series to draw insights on how to win this Festive Season 2022.

Discover our top three lessons derived from historical trends and some free insights from our share of visibility and share of voice data series. Here is how Chocolate, Salty Snacks and Savory Biscuits manufacturers competed for in-store and in catalogues to win the 2021 Festive battle. Will 2022 look the same?

3 Lessons to Win During the Festive Season

From our Share of Visibility and Share of Voice data series, 2021 data.

Lesson No. 1

Salty snacks brands might not register a high share of voice in-catalogue but don’t underestimate the off-location investments they make to increase their share of visibility in-store. Salty snacks brands tend not to increase their space in-catalogue from mid-November to December. However, their share of display tripled during the same period.

Lesson No. 2

Manufacturers who have “Festive” SKUs as part of their portfolio will win the heart of shoppers and of their retail buyers. But no need to be a chocolate player to make the season yours! As illustrated within the confectionery category, winning manufacturers are those who activate their festive and gifting assortment which helps them benefit from a large share of visibility in-store and in-catalogues. Indeed, the gifting and seasonal segment recorded a 70 percent share of catalogue within chocolate in December 2021. But why not swap the traditional favorites for a box of premium savory biscuits at your next Christmas dinner instead? Some players like Tyrrells in the UK are launching limited edition packaging to fit the sharing and entertaining theme.

Lesson No. 3

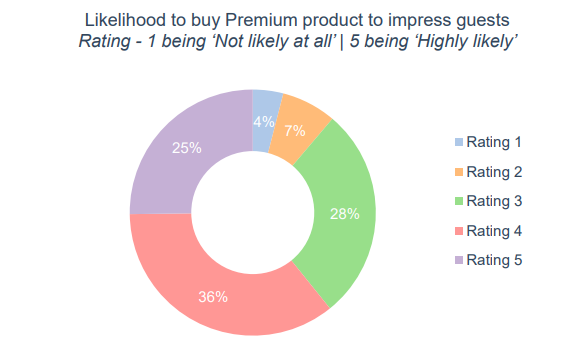

Make sure your below-the-line investments reflect the willingness of shoppers to trade up over the festive period and rethink your mix of displays and catalogue ads to achieve a higher share of premium brands. According to a study conducted by Snooper in 2021 during Christmas, 60 percent of shoppers will upgrade to premium snacks to impress their guests.

However, when looking at in-store off-location space, mainstream potato share of off-location is increasing by 50 percent at the detriment of premium potato over the three weeks leading up to Christmas. There is thus room to push a more premium offering of snacks on displays to better answer shoppers’ needs.