Editor’s Note: This blog was originally published by Snooper App. Snooper App was acquired by Wiser Solutions in 2022 and this blog has been revised and repurposed for a global audience. A version of this blog is also published in National Liquor News.

In our last blog post on the RTD category, we focused on the rise of hard seltzers and how to leverage Wiser Solutions’ RTD Data Series to further grow your brands in this space. But hard seltzer is just one part of the RTD story …

There are several subcategories that fall under the broader RTD umbrella, such as hard lemonade, hard kombucha, hard iced tea, spritzers and packaged cocktails to name only a few.

Since the pandemic, cocktail consumption has been on the rise and this has taken a number of forms, including the convenient ready-to-drink formats.

Hard Seltzer

Hard seltzer has come quite a way in six months. Mid-last year they were lacking a category home in store, split across locations in both the fridge and floor. Fast forward six months and not only have the number of seltzer brands and thus facings proliferated but there is also more consistency in category blocking and adjacencies, with seltzers potentially even over faced in some stores. This is sometimes at the expense of other categories such as cider. Additionally, seltzers are gaining share of off-location display slots.

‘Hard’ Refreshment Alternatives

RTDs increasingly include a number of entrants from the hard kombucha, hard lemonade, and hard iced tea categories, with hard kombucha sales increasing 2000-plus percent year on year in the US, hard iced tea growing nearly 500 percent, and hard lemonade seeing growth of more than 400 percent.

The growing desire for better-for-you products has resulted in the demand for health-related attributes such as probiotics and natural ingredients. Accordingly, we are seeing the introduction of an increasing number of new hard refreshment brands, ranging from Byron Kombucha Brewing Company’s national distribution in BWS and Dan Murphy’s of two products (the Dirty Bucha gin and vodka, and the Sneaky Bucha kombucha and beer combination), to Matso’s Hard Lemonade, Brookvale Union’s Hard Iced Tea and Spruce Hard Cold Brew Coffee.

Spritzers

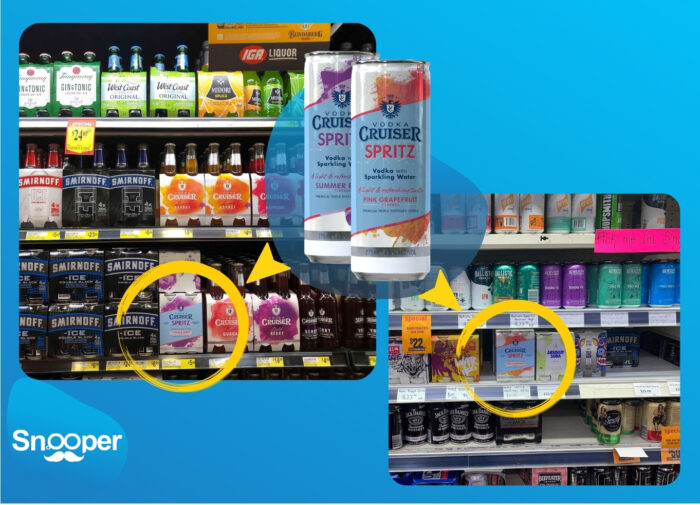

There have been a number of recent new product launches in the spritz space, with the base liquors including wine, aperitifs, and spirits. For example, Aperol Spritz has launched in an RTD pack and gained shelf space just in time for summer, while Vodka Cruiser’s Grapefruit and Berry Spritz SKUs are being ranged within the Vodka Cruiser block.

Other players in the category include the Australian upstart Big Shot with flavors including berry lime, margarita lime, and fruit passion. Wine spritzers such as Brown Brothers’ Prosecco and Moscato four-pack spritzers have also been spied by our mystery shoppers in the RTD fridge and there might be a question on the best location for wine-based spritzers in store (in the RTD fridge or next to other chilled wine cans).

Premix Cocktails

The pandemic has seen the rise of the cocktail-at-home occasion, whether enjoyed individually or with others. Research by Bacardi indicates that close to 30 percent of consumers claim they plan to purchase RTD cocktails or canned spirit and mixers, with portability and convenience cited as key reasons for stocking up on a pre-made drink.

Consumers are enjoying purchasing cocktail kits for simple cocktails such as Negronis, Margaritas, and Espresso Martinis; and Aperol, Campari, Pimms, and Malibu-based drinks they can make for themselves and for selected groups of friends at home, and this is being noticed in both in-store purchases and home delivered orders.

Aside from well-known distributors such as Vok Beverages offering pre-made cocktails, since the pandemic, a number of well-known cocktail bars in each state are now offering pre-bottled (or pre-canned) cocktails to consumers direct. So RTDs are now expanding to include cocktails at home.

What About ‘Traditional’ RTDs?

Beyond new flavors, UDL and Vodka Cruiser have been experimenting with variety packs of different flavors to allow shoppers a mix.

And Then There’s Canned Wine

According to IRI figures, canned wine is worth more than $8.5 million in Australia and has been recording 30 percent year-on-year growth. Ben Culligan of Treasury Wine Estates attributes this to millennials, as: “canned wine is introducing wine to younger adult shoppers, 22 percent of whom are new to the wine category,” and who may not be looking for an entire bottle for their consumption occasion. Wine in a can talks to a variety of occasions in which wine may not previously have been seen.

Until recently, RTD was taken to mean a spirit with a traditional mixer or flavor in a can or bottle. However, the proliferation of types of drinks in cans means that the definition of the category needs to be expanded along with its space in the fridge.