Editor’s Note: This blog was originally published by Snooper App. Snooper App was acquired by Wiser Solutions in 2022 and this blog has been revised and repurposed for a global audience. A version of this blog is also published in National Liquor News.

Analysts have highlighted that the increasing trend toward health consciousness might be a threat to the liquor industry and a decline has been observed in the proportion of Australians consuming alcoholic beverages. However, this trend also represents an opportunity for innovation in the sector and a potential key to unlocking new growth prospects.

Although the worldwide movement toward moderation is undeniable, consumers are also looking for “better for you” alternatives which translate into higher mindfulness around ingredients and the search for drinks with lower carbs, lower sugar, and lower alcohol content.

Major liquor players have indeed been responding to the commercial pressure initiated by this trend for a few years already, notably by innovating in the RTD segment. With a brand-new qualitative offer of RTDs presented in premium packaging and focused on low alcohol, low sugar, and natural ingredients that appeal to these health-conscious consumers, brands managed to reverse the market opinion.

Now associated with the positive ideas of convenience and innovation, RTDs are successfully fighting for their share in the Aussie alcohol market.

Here are a few examples of the NPDs answering this trend over the past years. In 2015, Pernod Ricard launched Absolut Botanik, positioning this 5.7 percent ABV drink as a less sweet vodka premix with botanical flavors. Diageo also promoted Smirnoff Pure as a 4.5 percent vodka premix with no preservatives or artificial ingredients. Sugar-free products were also introduced in market, such as Wild Turkey and Zero Sugar Cola or Vodka Cruiser Sugar Free.

As the health consciousness trend continues to rise with 42 percent of Australians monitoring how much sugar is in their diet, brands are now forced to keep innovating to stay competitive and are now heavily investing in an emerging category that is becoming the star in the RTD fridge: the hard seltzer or alcoholic seltzer category.

While these products may be new in Australia, data from Nielsen shows sales in the United States have skyrocketed 193 percent since last year. In the first six months of 2019, Americans spent $389 million on hard seltzer, which was an increase of 210 percent from 2018. Industry analysts are predicting the alcoholic seltzer market will reach $1 billion in sales in the US this year and could be worth $2.5 billion by 2021. This clearly shows that hard seltzers answer current consumer trends. This lower carb and lower sugar alcoholic alternative is perfect for the growing afternoon with friends occasion while it also capitalizes on the convenience of cans as a pack format.

In the context of COVID-19, RTD is one of the categories that doesn’t heavily rely on the on-trade space, which makes it even more interesting to explore for many liquor players. We, therefore, expect the race for market shares to be fierce in the new hard seltzer category.

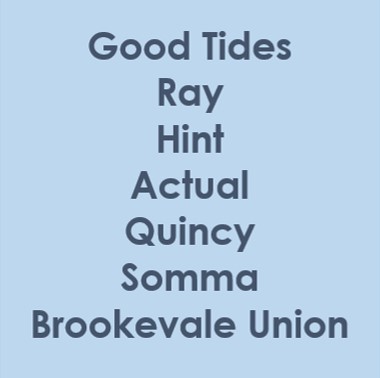

As a matter of fact, many brands have already recognized this opportunity and launched their alcoholic seltzers in Australia. We are already observing a fragmented market where smaller craft brands are competing with giants.

If Lion was the first major company to launch an alcoholic seltzer into the Australian market with the introduction of Quincy in November 2019, many others large players quickly caught up or are expected to do so this year. For example, Asahi released its vodka-based sugar-free seltzer Good Tides in March 2020. It was followed by Actual, launched by CUB in May 2020, and positioned as low-calorie ready-to-drink vodka, made with 100 percent natural ingredients to a vegan recipe. Lion also signed an agreement with Mark Anthony Brands International to introduce White Claw Hard Seltzer in Australia, which is already very popular in the US with close to 60 percent market share. Smaller players are battling hard as well and the following Aussie trendy brands are already available in national banners: Fellr and Sips for example.

It is important to recognize that despite the popularity in the US, the winning strategies will look different in Australia due to the particularity of our market. While the largest distribution channel for seltzers in the US is supermarkets—therefore allowing brands to create impulse purchases as part of broader shopping trips, brands in Australia will have to compete for space in liquor stores. In this context, designing the right where-to-play strategy, focusing on being strategically distributed in the stores with the highest potential (especially in the independent channel), and achieving execution excellence in the fridge will be critical.

To help liquor players make the most out of this trend and generate growth in the off-trade space despite the current crisis, Wiser Solutions launched a new syndicated data series to help them track the ever-changing RTD category—including hard seltzers—with a focus on independent liquor stores.

Brands Are Competing For Space

With the proliferation of players in the Hard Seltzers category, brands are fighting to increase their number of facings in RTD fridges, especially in indies.

Single pack type can be a great trial format for new category buyers and can help you claim more space. See the image below, with 16 facings with Actual having the lowest share due to the unavailability of single cans.

Indies is a strategic channel to grow distribution and market shares. Small brands are fighting hard for space. For example, Ray has 4 times more facings than Quincy in this Bottle-O in metro QLD.

National banners are also allocating significant space to this emerging category. In the image below, 12 facings in this Liquorland in WA are equally split across three brands (vs. 20 facings allocated to the gin-based RTD category).

Monitor new player entrance and benchmark competition to build a data-driven battle plan. Subscribe to our data series to track KPIs such as brand penetration, price, promo mechanics, pack types, number of facings, the position on the shelf, and much more.

Seltzers Will Also Be Competing For Space With Other Innovations: Is Hard Kombucha The New Seltzer?

Some stores have a bigger Hard Kombucha range and allocate more facings to this category than to Hard Seltzer.

Contact us if you’d like to have access to the full data set to track new category penetration and share of fridge to stay ahead of your competitors with your innovation strategy.

Planograms Are Inconsistent And Seltzers Are Adjacent To Different Categories Depending On Stores

How can brands and retailers team up to help shoppers navigate the fridge and implement the right planogram? When multiple seltzer brands are ranged, there are rarely blocked together. Adjacent categories also vary significantly. This lack of consistency in planogram raises questions on the easiness to find this emerging category in the fridge, especially in a context where brands need to raise awareness among the Australian shopper community.

Contact us if you want access to the full data set to assess what are the top adjacent categories and how it impacts the easiness to find your brand from a shopper perspective.

In the below image, seltzers are adjacent to gin, cider, and hard lemonade.

In this instance, seltzers are adjacent to hard kombucha in the cider fridge.

Here, seltzers are adjacent to hard lemonade, mango alcoholic drink, and below cider.

Seltzers are adjacent to whisky, cola, and espresso martini in this example.

Contact us if you’d like to access the full data set to benchmark your competition merchandising strategy and its impact on product visibility and easiness to find the seltzer category from a shopper perspective.