Editor’s Note: This blog was originally published by Snooper App. Snooper App was acquired by Wiser Solutions in 2022 and this blog has been revised and repurposed for a global audience. A version of this blog is also published in Inside FMCG.

Arnott’s and Mondelez recently launched new biscuit products at the same time, in differing ways. But who won in store, and what was the impact of the lockdown in Victoria?

Perhaps capitalizing on the consumer increase in snacking during COVID times, both Arnott’s and Mondelez launched new biscuit SKUs simultaneously. However, the products and the execution varied. It was a close call as to who performed better overall in shoppers’ eyes, with the brands each strong in different areas of in-store execution, according to us.

In early August, Arnott’s launched Shortbread Cream Tiramisu and Monte Carlo Black Forest as part of its new dessert-inspired range. Mondelez, meanwhile, launched two Oreos SKUs—Salted Caramel and Double Stuff.

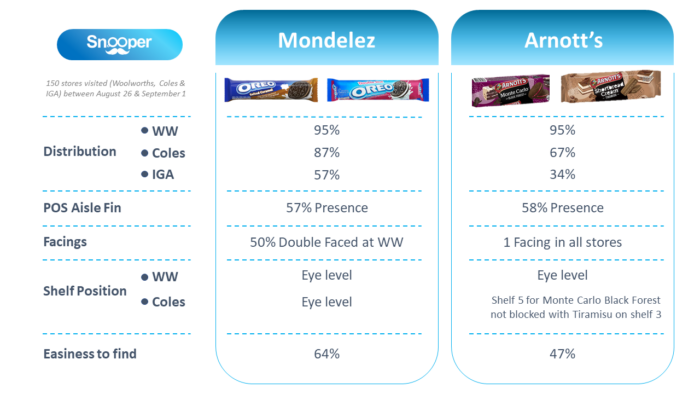

Our Snooper shopper community visited 150 Woolworths, Coles, and IGA stores between August 26 and September 1 (two weeks after the new products launched). Fifty percent of stores visited were in Victoria, in order to determine the impacts of the lockdown. Visits were conducted during a promotions week.

As part of our new products tracker, the shopper community assessed a range of in-store metrics across both brands including ranging, point-of-sale materials, facings and brand blocking, pricing and promotions, and importantly, ease of finding the new SKUs.

So Who Won Each Round?

Round No. 1—Ranging: Mondelez Is Ranged In More Stores

When it comes to ranging, the first difference observed in the manufacturers’ strategies was that Mondelez gave exclusivity to Woolworths on the Salted Caramel SKU.

When comparing speed to market, Mondelez was distributed in more stores than Arnott’s in the first weeks following the launch.

While the distribution for both brands was comparable at Woolworths with more than 95 percent of stores in the sample ranging all four innovations, in Coles, Monte Carlo Black Forest was the lowest available SKU with 67 percent distribution in the store sample versus 87 percent for Oreo Double Stuff; and Arnott’s Shortbread Tiramisu was the lowest distributed SKU at IGA in 34 percent of stores versus 57 percent for Oreo Double Stuff, highlighting that Mondelez pushed for a stronger focus on independents than Arnott’s.

As we noticed that only 17 percent of the IGA stores visited ranged all three new SKUs, we recommend identifying the innovation-driven indies ahead of a product launch in order to execute the best where-to-play strategy.

Round No. 2—POS: A Similar Execution For Both Brands

Both players invested in point-of-sale materials at Coles and Woolworths to support their launches with the execution ranking similarly for both players and aisle fins found in 55 percent of stores visited.

A few variations though, as Arnott’s was using one POS for both NPDs, while Mondelez was highlighting its Salted Caramel NPD at Woolworths only.

We observed that POS execution was a bit disrupted by the lockdown in Victoria as we identified 48 percent POS presence in Victoria versus 66 percent POS presence in other states (average POS presence of both brands in all banners), likely because retailer staff was focused on essential tasks such as replenishment and safety measure adherence.

Round No. 3—Promo & Pricing: Arnott’s Chose To Reflect The Premium Positioning Of Its Dessert Range

If shelf price is aligned at both Coles and WW, the price variance in regular shelf price is significant in the independent network with 15 percent difference between min and max for Arnott’s NPDs’ reported price (average price being around $3.2) and up to 35 percent difference between min and max for Mondelez Oreo Double Stuff reported price (average price being around $2.3)! Arnott’s is priced higher than Oreo, reflecting the premium positioning of their dessert range.

As far as promo prices are concerned, they are also aligned at both Coles and WW. The promo mechanics are the following ones: Arnott’s is doing 30 percent off at both Coles and Woolies while Modelez is doing 25 percent off of Salted Caramel at Woolies and “2 for $3” on Double Stuff at Coles.

The difference is significant at Indies level: if the independent network tends not to do promotion on the two SKUs from Arnott’s, it is promoting the Oreo Double Stuff price (but still, this promoted price remains 5 percent more expensive than the Coles and WW one.)

Round No. 4—Layout Strategy: Mondelez Wins With Double Facings In 50% Woolies

Mondelez wins at Woolworths when assessing the number of facings, with each Oreo SKU being double-faced in 50 percent of stores visited where the new Arnott’s SKUs were single-faced. However, at Coles and IGA, both manufacturers introduced their new products with one facing.

A noticeable difference has been observed in Shelf Ready Packaging as Oreo NPDs were consistently in SRP while Arnott’s Monte Carlo Black Forest was in SRP in 78 percent of stores and Shortbread Cream Tiramisu in 67 percent of stores only.

Round No. 5—Planogram Strategy

Both manufacturers launched their innovation in their brand block.

The winner of shelf position at Woolworths, using Shelf 2 (starting from the top)—the “eye level is buy level” shelf as the goal—goes to Arnott’s at Woolworths, with close to 80 percent of stores displaying the dessert inspired ranged at eye level compared to 60 percent for the Oreo new products. At Coles, the winning position is split between Arnott’s and Oreo due to the difference in planogram strategy.

While Woolworths tends to group all five dessert SKUs together, Coles is placing Arnott’s Shortbread Cream Tiramisu adjacent to other dessert SKUs while Monte Carlo Black Forest is adjacent to other Monte Carlo SKUs.

The split of the Arnott’s two new SKUs in a majority of Coles had a direct impact on the easiness to find the products. It seems that the lockdown in Victoria might have had an effect on planogram execution. Arnott’s new products were blocked in 60 percent of Victorian Woolworths stores versus 88 percent in other states.

Last Round—Easiness To Find: Mondelez Wins Where It Counts The Most

Easiness to find is an outcome of a combination of ranging, shelf position, adjacencies, and POS support and could be considered the pinnacle award. As Oreo was rated higher in easiness to find, it seems that the strategy of double facing and range distribution has paid off.

While the aisle fin didn’t seem sufficient to help Arnott’s win the race, in stores where Arnott’s had merchandising material, the easiness to find significantly increased: Arnott’s was 1.7 times easier to find in Woolworths stores where there was an aisle fin.

Another important finding for Arnott’s was that the planogram impacted the easiness to find their dessert-inspired range. The Woolworths strategy of blocking the range resulted in 52 percent of shoppers rating the SKUs high or very high on easy to find versus only 41 percent for Coles.